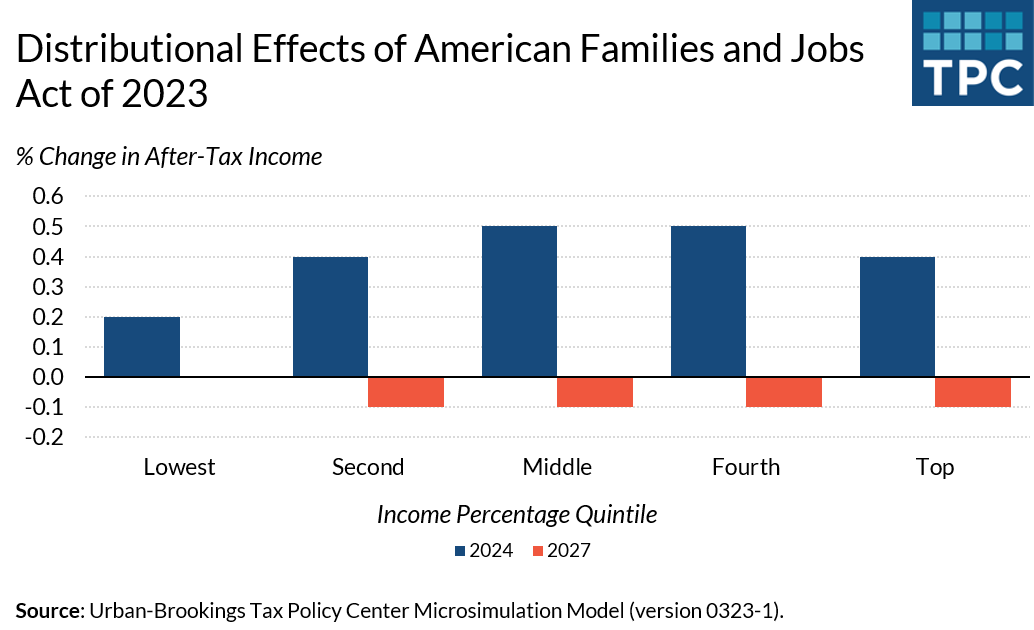

2025 Business Auto Deduction - Deductions For Business Expenses 2025 Elane Harriet, This is the highest value you can use to calculate the depreciation on a car that is used for business purposes when you first use or. Tax Policy Center on Twitter "A House GOP tax plan would raise the, The biggest benefit of the current.

Deductions For Business Expenses 2025 Elane Harriet, This is the highest value you can use to calculate the depreciation on a car that is used for business purposes when you first use or.

Vehicle Tax Deduction 2025 Zelma Barbabra, The irs has released new tax brackets for 2025, and in this video, we break down what you need to know.

TAX TIPS! Business Auto Deductions YouTube, For the 2025/25 financial year, the car limit is $69,674.

Add your Biographical Information. Edit your Profile now.

25 Small Business Tax Deductions (2025), Join over 95,000 small business owners in signing nfib’s petition to stop the massive tax hike by making the 20% small business deduction permanent.

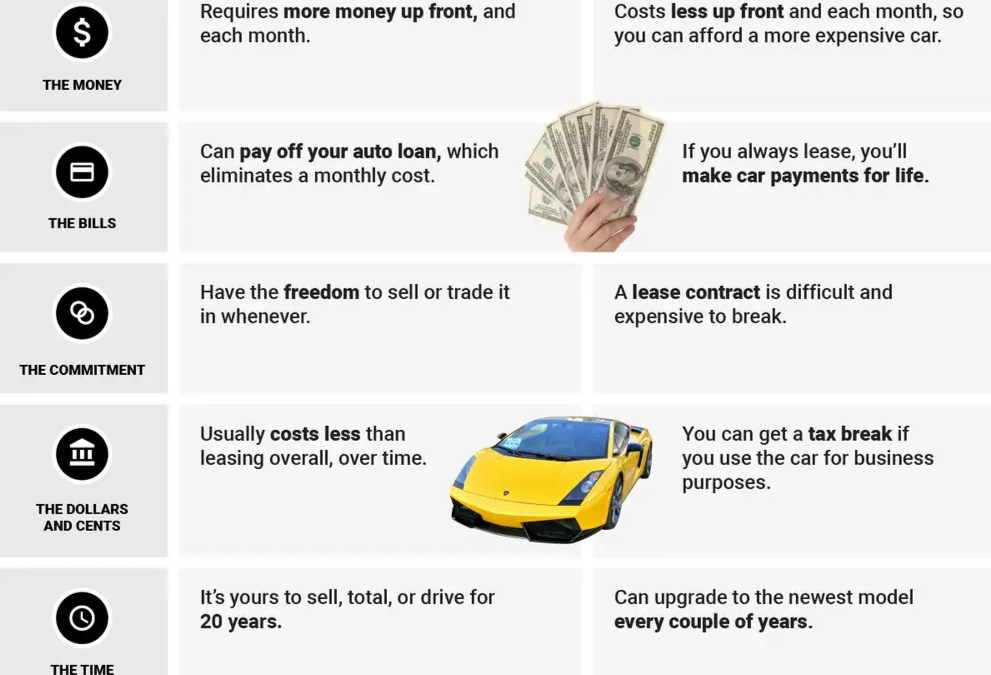

Which strategy is best for me with my car, truck, or SUV?, Join over 95,000 small business owners in signing nfib’s petition to stop the massive tax hike by making the 20% small business deduction permanent.

Restoring 100% bonus depreciation to boost capital. For the 2025/25 financial year, the car limit is $69,674.

Business Vehicle Deduction 2025 Muire Tiphani, The ato has announced the latest cents per km rate for business driving:

Business Vehicle Deduction 2025 Muire Tiphani, Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction to support their digital operations and digitise their.

2025 Business Tax Deductions Lola Lillian, The ato has announced the latest cents per km rate for business driving:

Auto Deduction Strategies PPS Accounting, Here's how to calculate depreciation deductions for cars, suvs, pickups and vans used in your business.

2025 Business Auto Deduction. Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction for external training courses delivered to. Small businesses with an aggregated annual turnover of less than $50 million will be allowed an additional 20% tax deduction to support their digital operations and digitise their.